3 min read

Diamond Economics: Toxic Inventory is a Silent Killer

![]() Kunal Mehta

:

May 22, 2023 6:20:47 PM

Kunal Mehta

:

May 22, 2023 6:20:47 PM

A paradigm shift in the diamond market is impacting businesses in the jewelry value chain as pricing volatility calls for new strategies.

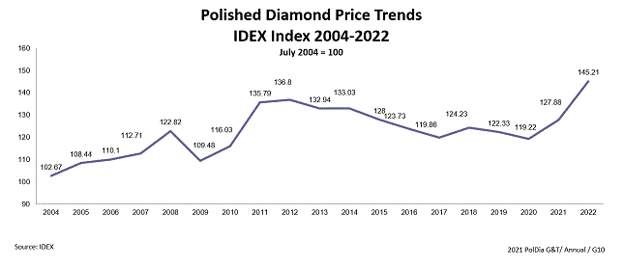

How diamond prices changed over time

In 1948, De Beers transformed consumers’ perception of diamonds with the iconic slogan A diamond is forever, which cemented the link between love and diamonds. As more couples sought to mark their engagement with a symbolic solitaire, the price of diamonds started to rise. Antwerp diamond manufacturer Ajediam has tracked diamond price data since the 1960s, and has a graph that shows the average price per carat in 1960 was $2,700 (Diamond Prices Index puts that price at about $10,410 in April 2023).

Diamond prices enjoyed a steady rise throughout the 21st century, right up until the global financial crisis in 2008. The stability and predictability in the diamond market had shaped the business models of the companies operating within its supply chain: manufacturers, wholesalers, brands, retailers.

The Great Recession represented an inflection point in the diamond market’s pattern of behavior. Prior to 2008, prices for most diamond articles rose steadily over the years. In the 15 years since 2008, there has been significant and unprecedented volatility in the sector, including various periods of sustained price depression.

There are a number of factors that have contributed to this volatility:

- Unexpected black swan events (e.g. the subprime mortgage crisis in 2008, or the COVID pandemic in 2020)

- The advent of lab-grown diamonds

- Increased price transparency due to the internet and social media

- One-off changes in supply pipelines (i.e. the closure of the Argyle diamond mine in Australia)

- Vertical integration in the supply chain

- Geo-political instability and sanctions

The image below, published by the International Diamond Exchange (IDEX), illustrates the volatility that the industry has endured over the past two decades.

How to optimize diamond inventory for improved profitability

Experts know that a zero-inventory model will be nearly impossible to achieve in the jewelry industry for many reasons:

- Consumers expect to touch and feel fine jewelry before purchasing

- Until recently, there has been a lack of comprehensive, clean data standards in the industry at large, resulting in a lack of inventory projections the industry has faith in

- A just-in-time inventory business is very difficult to scale effectively because of the unpredictability in demand and very high raw material costs

- Consumers expect choice and personalization, resulting in a long tail of SKUs that generate significant revenue at retail

Until fairly recently, holding inventory has not been a burning problem for players in the value chain. The appreciation in raw material pricing was consistent and predictable for years, and demand outweighed supply. This created a marketplace in which it was not as difficult to turn inventory as it is today. Optimizing inventory has always been important to running lean businesses, but it was not a widespread existential problem in the diamond jewelry supply chain until this century, and specifically in the past decade. There has been a fundamental change to the two key KPIs that define the financial health of the members of the value chain: profit margins and inventory levels.

Net profitability has slowly eroded over the past decade. Throughout the supply chain, a reduction in profit margins has occurred for various reasons: The internet has made diamond prices more transparent, and that has irrevocably changed retail pricing. Supply-side and demand-side consolidation, and the resulting vertical integration, have accelerated the race for market share, consequently enabling the biggest players to work on tighter gross margins.

The market is near a saturation point: supply has caught up with demand, resulting in a buyer’s market. Much of the instability that has triggered bankruptcies and insolvency in the industry this century has been a direct result of a reduction in the bottom line.

There is also a silent killer that has contributed to the demise of the financial health of many long-term players in the industry: a shift in inventory behavior. For most serious industry players, inventory and receivables are the biggest contributors to assets declared on balance sheets. Once considered a darling asset, certain qualities of diamond inventory should now be considered a depreciating asset during years in which prices stagnate or fall.

This is a concept that did not have to be seriously entertained until very recently. In order to sustain a healthy business in a profitable manner, the depreciation of ‘toxic’ diamond inventory (i.e. rejection goods, off-sizes, aged memo jewelry inventory, diamond jewelry that will be melted) should be managed much more conservatively. This problem is exacerbated in the lab-grown segment of the industry, where inventory costs are far less stable than natural diamond inventory costs, yet the same business model is being utilized to bring merchandise to market. Retailers and vendors that do not address this problem proactively will be more prone to bankruptcy or insolvency.

Inventory innovation: Jewelers must adapt to survive

From this harsh reality, an opportunity for serious change has presented itself. In a macro sense, the diamond and jewelry industry remains healthy and vibrant. There is significant growth potential in markets such as India and China. In developed markets like the USA there is an opportunity to capitalize on increased spending on jewelry derived from a rise in self-purchasing. Jewelry remains one of the best gift items on the market, in addition to being a premier accessory used for self-expression.

In order to take advantage of this evolving marketplace, inventory holders must evolve their business by:

- Adopting best practices from other industries

- Embracing technology

- Replacing maverick decision-making with a data-oriented approach

The technological revolution in our industry started later than most, but successful adaptation to the changes it brings will define the winners and losers in the next chapter of this fascinating industry.